7 Explain the Difference Between Expected Return and Realized Return

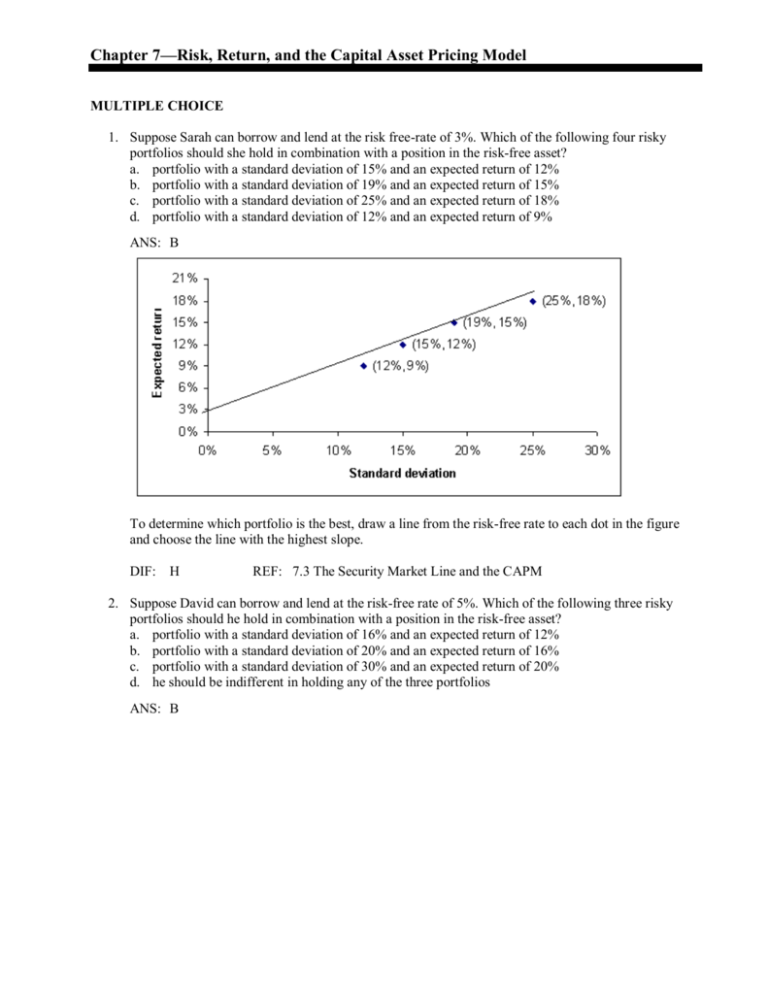

Expected rate is the rate an investor can expect to realize if the investment is made and realized return is actually buying an asset. Return is how much an investment earns or loses over time reflected as the difference in the holdings dollar value.

Return On Investment Roi Definition Equation How To Calculate It

The expected rate of return is the amount you expect to lose or gain on an investment over a time period and this lacks certainty due to market changes interest rates and other factors.

/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)

. Expected return Expected return is the return which an investor expects from an investment. It basically depends on how you define measure risk. One approach relies on the expected link between future realized returns and Et-1rt while the second approach relies on the expected relation between Et-1rt and firm-specific priced risk.

If the security is valued correctly the expected return will be equal to the required return and the net present value of the investment will be zero. Consider the same 10000 investment that earns 1000 in the first year for a 10 percent rate of return. We have noted that yield to maturity will equal the rate of return realized over the life of the bond if all coupons are reinvested at an interest rate equal to the bonds yield to maturity.

Elton considers the information events that generate differences between expected and actual returns to be a combination of two distributions. The realized return tells you what you would actually make if you held the investment over this period month or. Between implied and realized variation or the variance risk premium is able to explain a nontrivial fraction of the time-series variation in post-1990 aggregate stock market returns with high low premia predicting high low future returns.

Rate of return refers to a value that indicates how much return is generated based on the initial investment. It consists of two components 1 capital appreciation and 2 is an income component. Realized Rate of Return.

Expected return means the return investors expect to realize if an investment is made. March 30 2022 An interest rate represents how much interest must be paid on a loans principal amount. Treasury note plus a risk premium.

Alpha though is the actual return in excess of this expected return. The realized return is what you would actually make if you hold the investment so this is the number you care about. Explain what the standard deviation of returns is and why its is very useful in finance.

Chapter 7 71 Returns. Almost all of the testing I am aware of involves using realized returns as a proxy for expected returns. However using information on the stocks history its volatility and its overall market returns you can reasonably estimate what the rate of return will be over a period of timeThis is the expected rate of return.

About the actual rate of return now which I assume to be the realized return. Factor an inflation rate of 3 percent. What you actually think you might make back.

Realized return per month 1450 Arithmetic average return per month 1595 The realized return per month as computed in Problem 10-5 is the compounded monthly growth rate of a one dollar investment for the stock from August 1994 to August 1997 for a total of 36 months while the one computed in Problem 10-6 is the sum of all the monthly returns divided by the number. Because the dividend yield is common to both estimates the difference between the expected and realized return equals the difference between the. In contrast the realized return is the dividend yield plus the rate of capital gains Pt Pt-1 - 1.

Both numbers are useful. Elton tests whether they are related to the. Maybe Im misunderstanding the question - but the beta in the CAPM is calculated using historical returns its the slope of the regression line between the asset returns and market returns.

That beta can then be used to calculate expected future return for an asset. Expected Return Realized Return and Asset Pricing Tests Digest Summary. Expected return and standard deviation are two statistical measures that can be used to analyze a portfolio.

Experts are tested by Chegg as specialists in their subject area. View the full answer. The expected return of a portfolio is the anticipated amount of returns that a portfolio may generate whereas the standard deviation of a portfolio measures the amount that the returns deviate from its mean.

The expected return of a. If you take more risk you expect more return to compensate you for taking the risk. One is normally distributed and the other approximates a jump process.

The realized rate of return employs the same financial concepts of the rate of return and but it also makes an adjustment for the dollar-depreciating nature of inflation. However if the required return is higher than the expected rate the investment security is considered to be overvalued and if the required return is lower than the expected the investment security is undervalued. The average return is useless.

We review their content and use your feedback to keep the quality high. Explain what an expected return is. This is the fundamental rule of finance.

The expectation is based on the return of a risk free investment such as a US. First the relationship between risk and expected return is positive. Expected return and standard deviation are two statistical measures that can be used to analyze a portfolio.

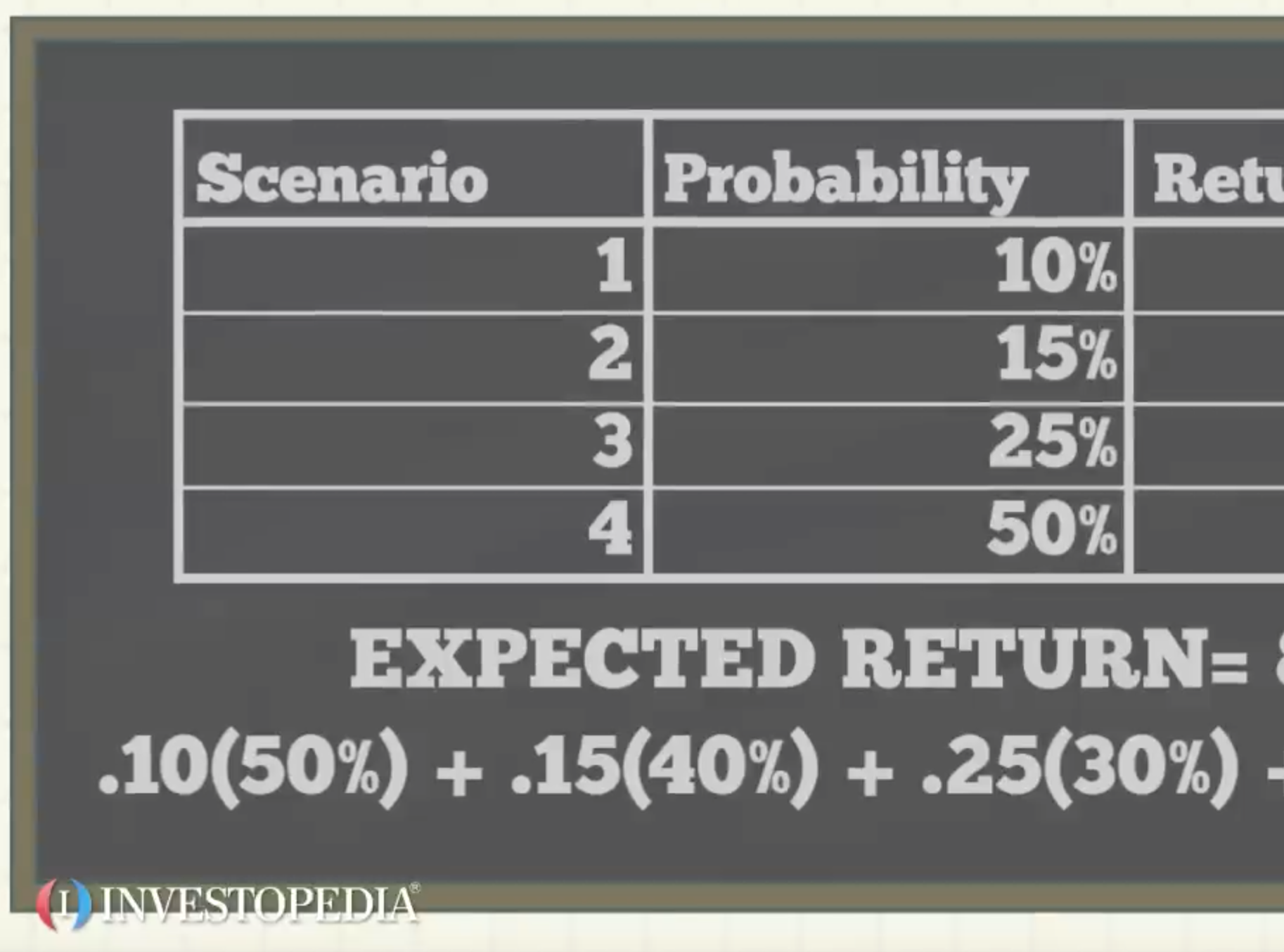

The use of average realized returns as a proxy for expected returns relies on a belief that information surprises tend to cancel out over the period of the study and realized returns are therefore an unbiased estimate of expected returns. A weighted average of the possible returns from an investment where each of these returns is weighted by the probability that it will occur. In case of a higher risk a higher return is expected to compensate for the increased risk.

The truth is in a volatile market its impossible to know what the exact rate of return will be on an investment. The difference between rate of return and interest rate is based on the nature of returns on investments and interest paid on a loan. In contrast the rate of return is how much you actually end up gaining or losing on that investment.

Describe the difference between a total holding period return and an expected return. The yield is forward. Consider for example a two-year bond selling at.

Realized return is the return actually earned by buying an asset. The holding period return is the total return over some investment or holding period.

Low Volatility Anomaly Wikipedia

The Risk And Return Relationship Part 1 P4 Advanced Financial Management Acca Qualification Students Acca Global

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

Chapter 7 Risk Return And The Capital Asset Pricing

Return On Investment Roi Definition Equation How To Calculate It

The Risk And Return Relationship Part 1 P4 Advanced Financial Management Acca Qualification Students Acca Global

:max_bytes(150000):strip_icc()/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)

What Is The Formula For Calculating Capm In Excel

What Is The Expected Return On A Stock Martin 2019 The Journal Of Finance Wiley Online Library

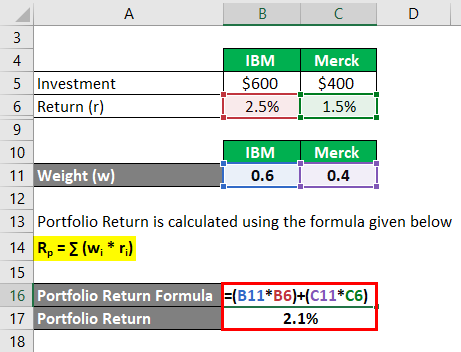

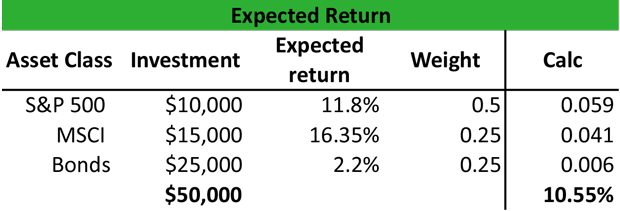

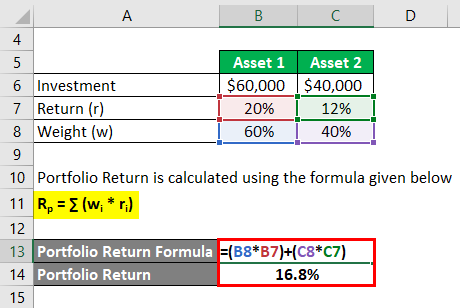

Portfolio Return Formula Calculator Examples With Excel Template

What Is The Expected Return On A Stock Martin 2019 The Journal Of Finance Wiley Online Library

Portfolio Return Formula Calculator Examples With Excel Template

(77).jpg)

Concept Of Risk And Return Quiz Proprofs Quiz

What Is An Expected Return Definition Meaning Example

Portfolio Return Formula Calculator Examples With Excel Template

/dotdash_Final_Excess_Returns_Dec_2020-01-2a81d7a448684458b0ed30db04fd145c.jpg)

:max_bytes(150000):strip_icc()/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)

/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)

Comments

Post a Comment